Heading 1: Understanding the Signs of a Recession

Heading 2: What is a Recession?

A substantial drop in economic activity that persists for more than a few months is commonly referred to as a recession. Typical indications consist of:

- A drop in GDP (Gross Domestic Product)

- Rising unemployment rates

- Decreased consumer spending

- Declining industrial production

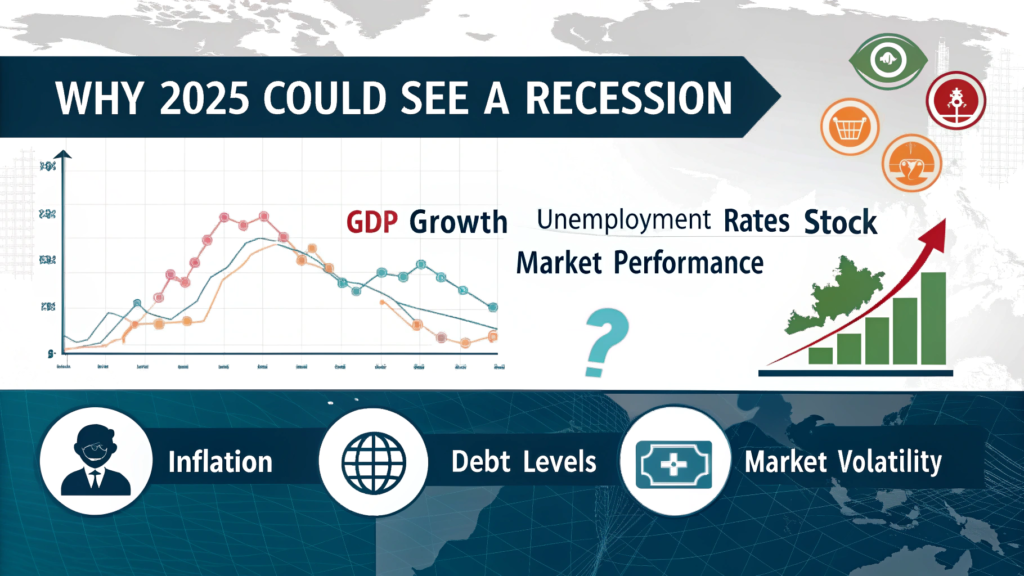

Heading 2: Why 2025 Could See a Recession

Several factors suggest that 2025 could be a challenging year for the global economy:

- High Interest Rates: Central banks worldwide have raised interest rates to combat inflation, which could slow economic growth.

- Geopolitical Tensions: Ongoing conflicts and trade disputes can disrupt supply chains and increase costs.

- Debt Levels: Both consumer and government debt levels are at record highs, creating vulnerability in the economy.

Heading 1: Building a Recession-Proof Budget

Heading 2: Track Your Expenses

Knowing where your money is going is the first step in being ready for a recession. Track your monthly spending with spreadsheets or budgeting applications. Divide them up into:

- Needs: Rent, utilities, groceries, and transportation.

- Wants: Entertainment, dining out, and non-essential shopping.

Heading 2: Cut Non-Essential Spending

Determine where you can cut expenses. For instance:

- Cancel unused subscriptions.

- Cook at home instead of dining out.

- Opt for free or low-cost entertainment options.

Heading 2: Build an Emergency Fund

An emergency fund is your financial safety net. Aim to save at least 3-6 months’ worth of living expenses. Start small if necessary, but be consistent.

Heading 1: Smart Saving and Investing Strategies

Heading 2: Diversify Your Investments

During a recession, diversification is essential for lowering risk. Think about:

- Stocks: Focus on defensive sectors like healthcare and utilities.

- Bonds: Government bonds are generally safer during economic downturns.

- Real Estate: If you have the means, real estate can be a stable long-term investment.

Heading 2: Avoid High-Risk Investments

Steer clear of speculative investments like meme stocks and extremely volatile cryptocurrencies when things are unclear. Remain with tried-and-true, low-risk solutions.

Heading 2: Maximize Retirement Contributions

Make the most of your employer’s 401(k) match if it is available. Tax advantages may also be obtained from contributions made to retirement accounts such as IRAs or Roth IRAs.

Heading 1: Managing Debt Effectively

Heading 2: Pay Down High-Interest Debt

During a recession, high-interest debt, like credit card balances, can easily become overwhelming. Prioritize paying off these debts by employing techniques such as the debt avalanche or snowball methods.

Heading 2: Refinance Loans

To reduce your monthly payments, think about refinancing your student loans, mortgage, or other obligations if interest rates decline.

Heading 2: Avoid Taking on New Debt

Avoiding needless debt is a good idea during a recession. If you must borrow money, just use it for necessities and choose low-interest loans.

Heading 1: Protecting Your Income

Heading 2: Upskill and Stay Employable

Layoffs are common during recessions. To safeguard your earnings:

- Invest in learning new skills.

- Stay updated on industry trends.

- Network with professionals in your field.

Heading 2: Consider Multiple Income Streams

Start a side business, work as a freelancer, or invest in passive income streams like dividend stocks or real estate to diversify your revenue.

Heading 2: Review Your Insurance Coverage

Make sure you have enough disability, life, and health insurance to guard against unforeseen circumstances.

Heading 1: Preparing Your Business for a Recession

Heading 2: Reduce Operational Costs

Reduce wasteful spending and bargain with suppliers for better prices. Pay attention to production and efficiency.

Heading 2: Strengthen Cash Flow

Keep a sizable cash reserve and send out bills on time. To enhance cash flow, provide early payment discounts.

Heading 2: Focus on Customer Retention

It is less expensive to keep current clients than to find new ones during a downturn. To keep customers interested, provide loyalty plans or value-added services.

Heading 1: Staying Mentally Prepared

Heading 2: Stay Informed but Avoid Panic

While keeping abreast of economic developments is crucial, refrain from acting on fear to make snap financial judgments. Adhere to your long-term strategy.

Heading 2: Practice Financial Discipline

Financial discipline is put to the test during recessions. Steer clear of pointless purchases and concentrate on your objectives.

Heading 2: Seek Professional Advice

See a financial expert if you’re unclear about your financial plan. They can offer tailored advice according to your circumstances.

Conclusion

Although a possible recession in 2025 can seem overwhelming, you can successfully navigate it if you are prepared. You will be more prepared to face financial difficulties if you create a sound budget, manage your debt, save prudently, and safeguard your income. Take action now to safeguard your financial future.