While the bulls are making a concerted effort to maintain the recovery above the critical support, Bitcoin’s short-term downturn is still ongoing. In addition, market sentiment has fallen to 30, indicating that they have resorted to dread. The price is currently moving toward a liquidity test as well as a crucial support area. It is anticipated that this cascade would start below $93,400 and might push the price of Bitcoin into the demand zone. btc price

Like the one that happened in the opening few days of the month, the cryptocurrency markets saw one of the biggest declines. Nearly 1,48,643 traders were liquidated in the last day, bringing the total amount of liquidations to approximately $379.24 million. Nearly 100x longs that had been made since Friday were liquidated as the price of Bitcoin reached the lows.

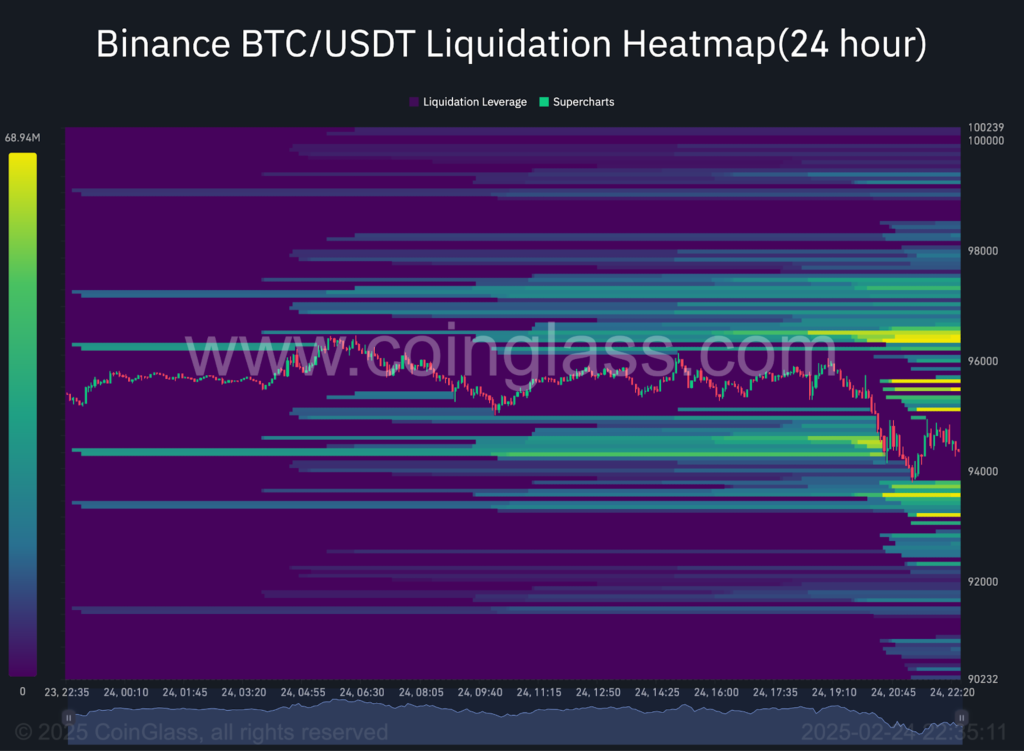

Coinglass’s liquidation heatmap above demonstrates that there is sufficient liquidity present on both sides of the price. This implies that traders desire to seize liquidity with a slight shift in the price of Bitcoin since they are uncertain about the future price action. Conversely, the amount of exchange inflows keeps decreasing, suggesting a decrease in on-chain activity, which often happens as a result of waning investor interest and network usage.

Is Bitcoin (BTC) Price Heading Back to $90,000?

According to a recent report, there is a resurgence in the retail market for Bitcoin. The 30-day demand has rebounded back to neutral after falling to -21%. Just prior to the start of the bull run in 2021, these levels were last observed. Similar price action is anticipated soon since in recent history, these recoveries have preceded significant market movements.

The price of Bitcoin has been under intense negative pressure lately, as can be seen in the following chart, which has maintained the token below the 50-day MA. As it hits a multi-month low, the Bollinger bands have also started to contract after staying consolidated inside a small range, suggesting reduced volatility. Nonetheless, it is thought that the price action that follows the squeeze will be enormous.

As a result, it is anticipated that the price of Bitcoin will continue to be heavily influenced by bearish sentiment for some time before likely moving into the demand zone. This might force the price to stay trapped at the Bollinger’s lower support band, which might lead to extremely bullish activity above the short-term highs.