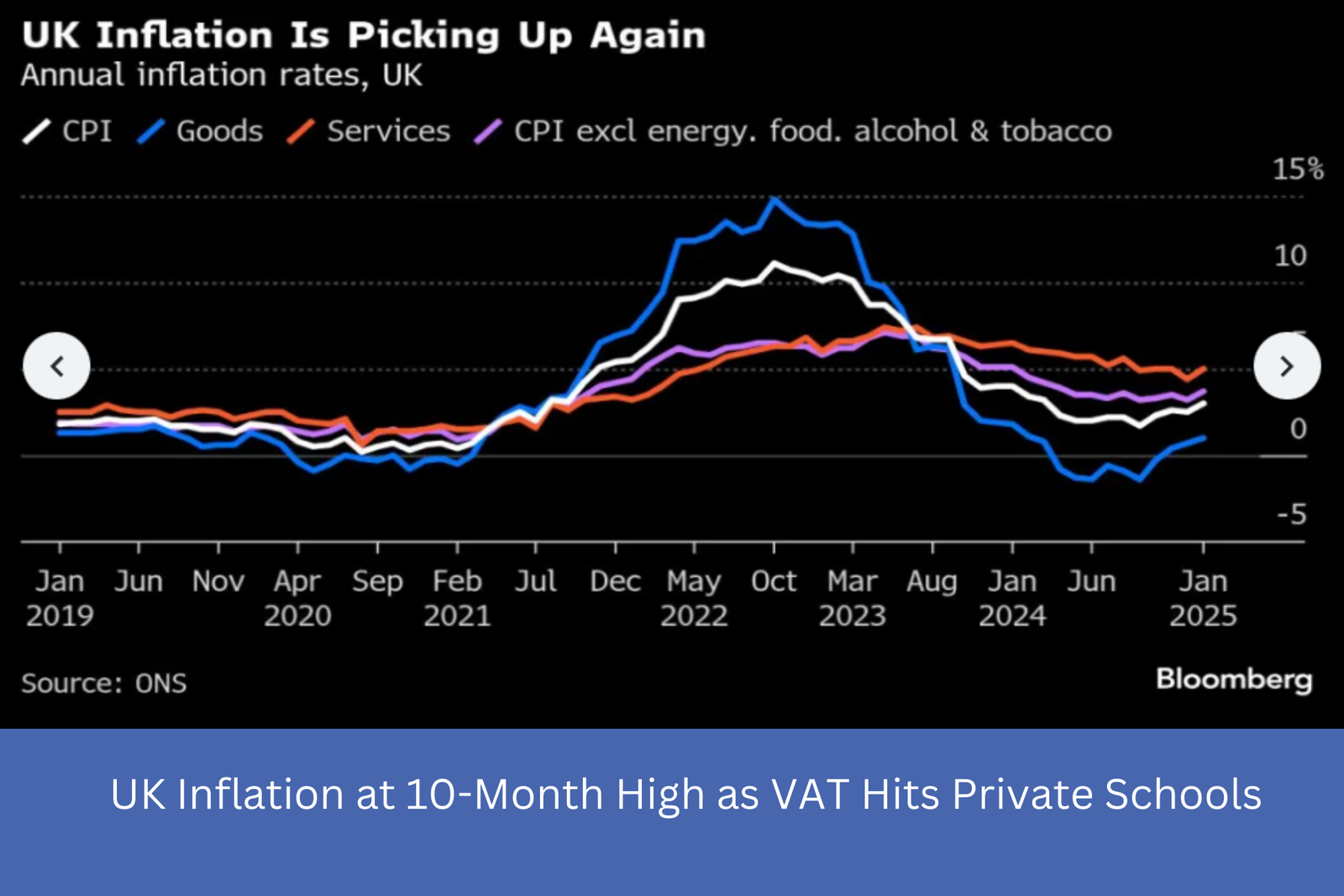

UK Inflation at 10-Month High as VAT Hits Private Schools

(Bloomberg) — In January, the cost of food, motor gasoline, airfare, and the value-added tax on private school tuition drove the UK’s inflation rate to its highest level in ten months.

According to data released Wednesday by the Office for National Statistics, consumer prices rose 3% from a year ago, up from a 2.5% pace in December. It exceeded the 2.8% prediction made by the Bank of England and economists.

Traders, however, found some solace in the services sector’s slower-than-expected price increase, which the BOE is constantly monitoring for indications of pressures coming from within the country. Although it increased from 4.4% to 5% last month, the BOE had forecasted 5.2% services inflation.

Softer underlying inflation caused the pound to recoup earlier gains. After reaching a new two-month high at $1.2640 earlier, sterling saw minimal movement at $1.2617. By the end of Tuesday’s trading session, traders were completely pricing in two further quarter-point cuts by the BOE in 2025.

The figures, which follow resilient labor market data on Tuesday, support the BOE’s cautious approach to cutting interest rates to support a moribund economy. While Governor Andrew Bailey has played down the threat from an expected surge in inflation this year, officials say they can’t rule out “second-round effects” keeping underlying pressures higher for longer. The BOE expects inflation to peak at 3.7% in the third quarter on the back of energy costs.

The numbers, which come after strong labor market statistics on Tuesday, back up the BOE’s cautious strategy of lowering interest rates to boost a faltering economy. Officials believe they cannot rule out “second-round effects,” which would keep underlying pressures higher for longer, even if Governor Andrew Bailey has downplayed the threat posed by an anticipated spike in inflation this year. Due to rising energy prices, the BOE anticipates that inflation will peak in the third quarter at 3.7%.

A March interest rate drop by the BOE is “improbable” due to higher inflation, according to Suren Thiru, director of economics at the Institute of Chartered Accountants in England and Wales. “These figures confirm a disheartening rebound in inflation, as the gap with the Bank’s 2% target was significantly widened by rising air fares and the introduction of VAT on private school fees.”

The contentious implementation of a 20% VAT on private school tuition, a Labour administration flagship program intended to help finance better public services, was one factor contributing to the inflation of services. January’s over 13% increase in private school tuition brought education’s annual inflation rate to 7.5%, the highest level in nearly ten years. Air fares also decreased last month, but not as much as they did in January 2024.

What Bloomberg Economics says…

The Bank of England will find the quicker-than-expected increase in inflation to be unsettling, but it is unlikely to raise any red flags. Food inflation was cited as the reason for the surprise.

More significantly, the rate of inflation in services was lower than anticipated.

—Economists Dan Hanson and Ana Andrade. To view the REACT on the Terminal, click.

Additionally, food inflation increased from 1.9% to 3.1% due to the rising cost of necessities like bread, pork, and cereals. At 3.7%, core inflation—which excludes volatile goods like food, energy, alcohol, and tobacco—rose to its highest level since April.

In spite of the restoration of real wage growth, Chancellor of the Exchequer Rachel Reeves stated, “I know that millions of families are still struggling to make ends meet.” The Labour government, which has seen a steep decline in the polls since winning the election last July, will be concerned about rising prices. Reeves’ October budget included tax increases totaling over £40 billion ($50.5 billion). The Conservatives accused the budget of making consumer and business cost problems worse.

Later this year, additional hikes driven by energy bills are anticipated to follow the most recent pickup, which moves inflation away from the BOE’s 2% objective. The third consecutive quarter of rising family gas and electricity costs was signaled by Cornwall Insight Ltd.’s prediction on Tuesday of another increase in the energy-price cap in April.

The economy, which has hardly expanded since Labour took office last July, is another issue the Monetary Policy Committee must deal with. Two of its nine members voted for a massive half-point drop earlier this month, which is causing splits.

According to Roger Barker, head of policy at the Institute of Directors, “stagflation, which combines high inflation and low growth, is the worst-case scenario for UK business.” “The inflation data from January hasn’t done much to reduce the likelihood of this happening.”

Interest rates were slashed by a quarter-point on February 6, the third since August, although the central bank cautioned that any additional cuts would be “gradual and careful.” Only two further cuts to 4% this year are priced into money markets.

Figures released on Tuesday that showed pay growth in the fourth quarter reaching an eight-month high and the employment market holding up better than anticipated further bolstered the argument for a cautious approach. According to tax data, there were more payrolled employees in January. Since the budget, when Reeves raised payroll taxes for businesses and promised yet another significant hike in the minimum wage, employment has decreased by less than 20,000.

“This morning’s hotter-than-expected inflation print will raise alarm bells at Threadneedle Street,” Zara Nokes, global market analyst at JP Morgan Asset Management, said, following yesterday’s high pay data. “The Bank of England will have a lot of trouble dealing with this week’s data, which also calls into question the decision to lower interest rates this month.”

Additionally, there were indications of increasing pressure on pipeline prices in the figures. January saw a 0.3% increase in factory gate pricing for goods before they are sold to retailers, which was more than the 0.1% prediction. January saw a 0.1% decrease in producer input prices for raw materials, which was less than the 0.6% reduction that was anticipated.

Most Read from Bloomberg Businessweek